Emergency Preparedness for Property Owners: How to Protect Your Investment

Owning a property in Ontario is both a rewarding and significant financial investment. Whether you're a landlord, real estate investor, or simply a property owner, ensuring that your asset is protected against unforeseen emergencies is crucial. Emergency preparedness isn't just about having a first-aid kit; it's about comprehensive planning and ensuring proactive measures are in place to safeguard your property and its occupants. In this blog post, we’ll delve into the importance of emergency preparedness and provide actionable steps to help you protect your investment.

Emergency Preparedness for Property Owners

Emergencies can strike without warning, ranging from natural disasters like floods and hurricanes to man-made incidents such as fires, break-ins, or utility failures. The potential risks and losses associated with these emergencies can be devastating. Without proper preparation, you may face significant financial losses, legal liabilities, and long-term damage to your investments.

Proactive measures with your emergency preparedness can help you mitigate these risks. By planning ahead, you can ensure the safety of your tenants, minimize property damage, and reduce any related financial losses. Moreover, a well-prepared properties is more likely to attract and retain tenants for a longer period, enhancing the overall value and appeal of your investment.

Creating an Emergency Plan for Your Property

Developing a comprehensive emergency plan tailored to your property is essential for ensuring the safety and well-being of both tenants and the property itself. Here's a detailed step-by-step guide to help you get started on creating a customized emergency plan that meets all your property's specific needs. You can also download our template below:

Identify Potential Risks: Assess the types of emergencies that could affect your property. Consider the geographical location, property type and main materials, property age, tenant profile (the type of tenants living in the property, students, elderly, etc) and any other specific vulnerabilities.

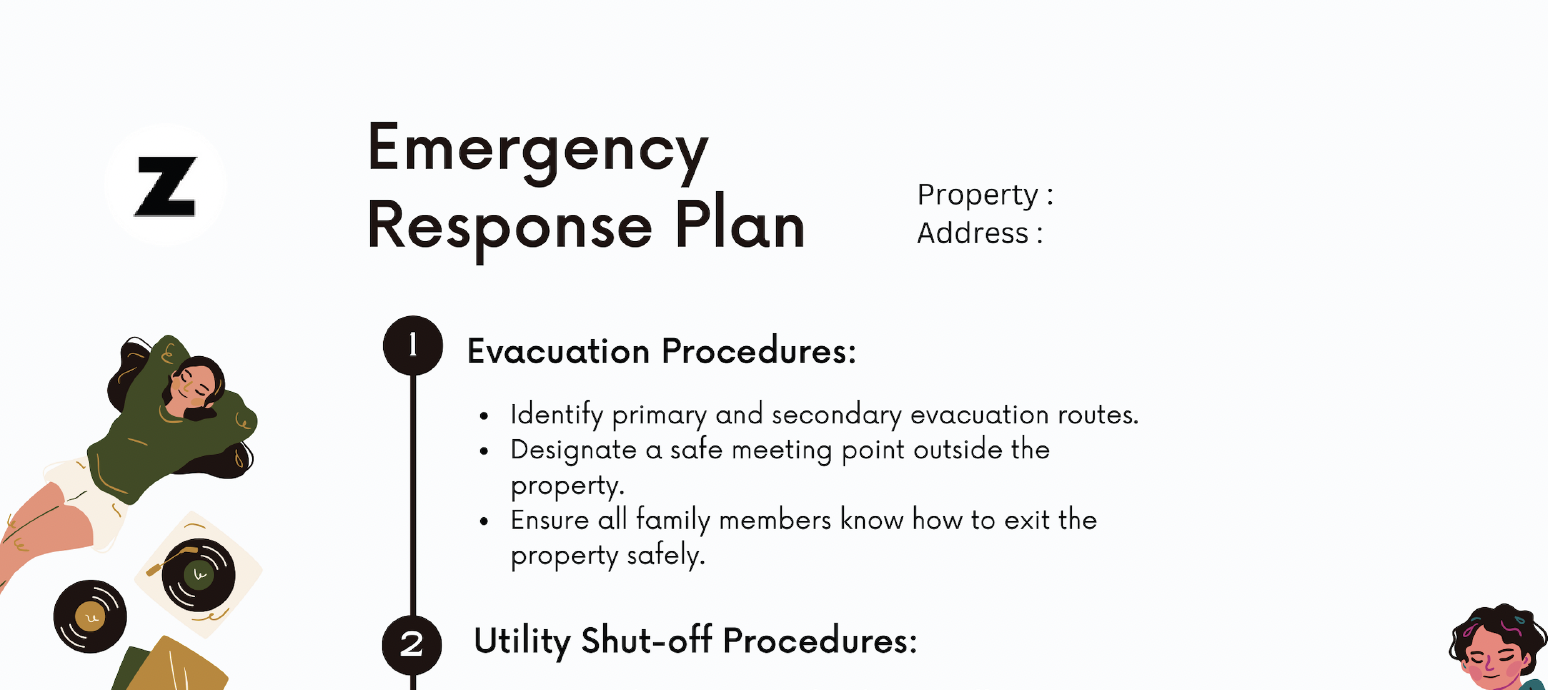

Draft an Emergency Response Plan: Outline the steps to be taken during different types of emergencies. Include evacuation routes, emergency contact numbers, and procedures for shutting off utilities.

Involve Tenants and Property Managers: Ensure that everyone involved with the property is aware of the emergency plan. Conduct regular meetings and drills to keep everyone informed and prepared.

Communicate Clearly: Provide tenants with written copies of the emergency plan and post important information in common areas. Use multiple communication channels to ensure that everyone receives the information.

Essential Supplies and Equipment for Emergencies

Having the right supplies and equipment readily available can make a significant difference during any unexpected situation or emergency. Below is a comprehensive list of essential items tailored for different types of emergencies, ensuring you are well-prepared for any scenario that may arise:

General Supplies: First-aid kits, flashlights, batteries, multi-purpose tools, and fire extinguishers.

Natural Disasters: Sandbags, waterproof tarps, and emergency blankets for floods; portable generators and fuel for power outages (if of course you’re willing to go above an beyond for your tenants);

Fire Safety: Ensure all smoke detectors, carbon monoxide detectors, fire alarms, and fire extinguishers are all in place and working as expected. A fire escape ladder can come in handy depending on the number of levels in the building.

It's essential to regularly check and maintain these supplies. Replace or fix faulty items and ensure that all equipment is in good working condition. Supplies can be purchased from hardware stores, online retailers, and specialized emergency preparedness suppliers such as the Home Depot or Canadian Tier.

Insurance Considerations for Property Owners

Insurance is undeniably a critical and indispensable component of emergency preparedness. It serves as a shield against unforeseen circumstances, providing a safety net for you in times of crisis. Understanding the nuances and specifics of insurance coverage is paramount in ensuring comprehensive protection for your valuable assets. Here's a breakdown of what you need to know about the vital role of insurance in safeguarding your investments during emergencies.

Types of Coverage:

Homeowners Insurance: This is your first line of defense. It typically covers damage to your home and personal property due to events like fire, theft, and certain natural disasters. However, it's crucial to read the fine print to understand what's included and what's not.

Flood Insurance: Standard homeowners insurance usually doesn't cover flood damage. If you live in an area prone to flooding, purchasing separate flood insurance is essential.

Earthquake Insurance: Similar to flood insurance, earthquake damage often isn't covered by standard policies. If you're in an earthquake-prone area, consider adding this coverage.

Landlord Insurance: If you’re renting out your property, landlord insurance is a must. It covers property damage, liability, and in some cases, loss of rental income.

Assessing Your Coverage Needs:

Evaluate Your Risks: Understand the specific risks associated with your property's location. Are you in a flood zone? Is your area prone to hurricanes, tornadoes, or wildfires? Tailor your insurance to address these specific risks.

Calculate the Value of Your Assets: Ensure your policy covers the full replacement value of your home and belongings. Underinsuring can leave you with significant out-of-pocket expenses in the event of a loss.

Consider Liability Coverage: Accidents happen. Liability coverage protects you if someone is injured on your property or if you cause damage to someone else’s property.

Understanding Policy Details:

Deductibles and Premiums: A higher deductible generally means lower premiums, but it also means you'll pay more out-of-pocket in the event of a claim. Find a balance that works for you.

Policy Limits: Know the maximum amount your insurance will pay for a covered loss. Ensure these limits are high enough to cover potential damages fully.

Exclusions: Familiarize yourself with what your policy doesn’t cover. Common exclusions include certain natural disasters, wear and tear, and intentional damage.

Regularly Review and Update Your Policy:

Annual Reviews: Life changes, and so do your insurance needs. Review your policy annually to ensure it still meets your requirements. Update your coverage if you've made significant improvements to your property or acquired valuable assets.

Document Everything: Keep an updated inventory of your belongings, including photos and receipts. This documentation can be invaluable when filing a claim.

Working with Your Insurance Provider:

Ask Questions: Never hesitate to ask your insurance agent or provider questions. Clarify any doubts you have about your coverage.

File Claims Promptly: In the event of a disaster, file your claim as soon as possible. Delays can complicate the process and prolong your recovery.

Know Your Rights: Familiarize yourself with the claims process and your rights as a policyholder. This knowledge can help you navigate the system more effectively during a crisis.

Additional Considerations:

Emergency Funds: Even with comprehensive insurance, having an emergency fund can provide immediate relief while waiting for claim settlements.

Mitigation Measures: Take steps to protect your property proactively. Installing storm shutters, maintaining your roof, and securing heavy furniture can reduce damage and potentially lower your premiums.

By understanding these critical aspects of property insurance, you can ensure that you are well-protected in the face of unexpected emergencies. Taking the time to assess, customize, and update your insurance coverage will provide peace of mind and safeguard your valuable investments both now and for years to come.

Maintaining Your Property for Disaster Preparedness

Regular maintenance is key to minimizing the impact of emergencies. Here are some tasks to help keep your property disaster-ready:

Inspect and Repair: Regularly inspect the property for potential hazards, such as structural issues, electrical problems, and plumbing leaks. Make sure you are address any repairs promptly.

Maintain Landscaping: Keeping trees and shrubs trimmed reduces risk of damage during storms. Clearing gutters and drainage systems regularly also helps prevent water buildup.

Test Safety Systems: Regularly test smoke detectors, carbon monoxide detectors, fire alarms, and security systems to ensure they are functioning correctly.

Create a Maintenance Checklist: Develop a checklist to track regular maintenance tasks and inspections. This helps ensure that nothing is overlooked and keeps your property in optimal condition.

Conclusion

Emergency preparedness is a vital aspect of property ownership. By taking proactive measures and developing a comprehensive emergency plan, you can protect your investment(s), ensure the safety of occupants, and minimize potential future losses.

Remember, the key points include understanding the importance of preparedness, creating an emergency plan, stocking essential supplies, reviewing insurance coverage, and maintaining the property for disaster readiness. Taking action now can make all the difference when an emergency occurs.

Ready to take the next step in safeguarding your investment? Start today by evaluating your current emergency preparedness measures and implementing the tips provided in this guide. Your future self—and your property—will thank you.